U.S. President Joe Biden said Friday that nearly 22 million people have applied for federal student loan relief in the week since his administration made its online application available — more than half of the number the White House believes are eligible for the program.

Later Friday, though, a federal appeals court issued an administrative stay temporarily blocking Biden’s loan cancellation plan. The Eighth Circuit Court of Appeals issued the stay while it considers a motion from six Republican-led states to stop the program.

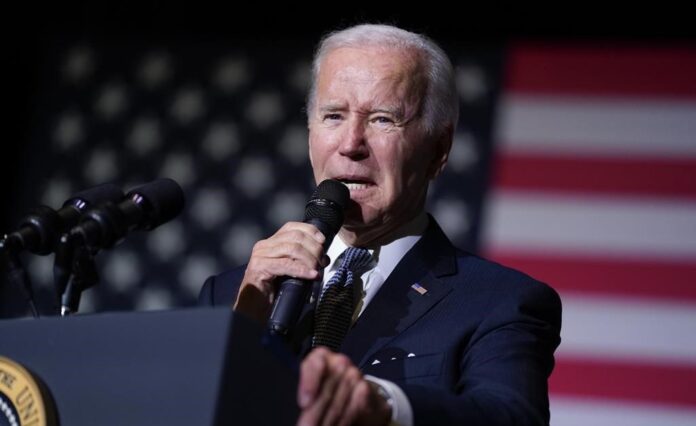

Speaking at Delaware State University, a historically Black university where the majority of students receive federal Pell Grants, Biden touted the first-week statistics since the application was beta-launched last Friday. He officially unveiled it at the White House on Monday.

Biden’s plan calls for $10,000 in federal student debt cancellation for those with incomes below $125,000 a year, or households that make less than $250,000 a year. Those who received federal Pell Grants to attend college are eligible for an additional $10,000. The plan makes 20 million eligible to get their federal student debt erased entirely, out of roughly 43 million eligible for at least some debt forgiveness.

Biden highlighted the ease of the application, which doesn’t require users to upload any forms or to create an account.

“Folks, it takes less than 5 minutes,” Biden said. He said the “vast majority” of applicants are able to submit for relief from their phones.

It’s unclear what the appeals court decision means for the millions who already applied for the relief. The Biden administration had promised not to clear any debt before Oct. 23 as it battled the legal challenges, but the soonest it was expected to begin erasing debt was mid-November.

White House press secretary Karine Jean-Pierre pointed out in a statement Friday night that the stay does not prevent borrowers from applying for relief, and it “does not prevent us from reviewing these applications and preparing them for transmission to loan servicers.”

“It is also important to note that the order does not reverse the trial court’s dismissal of the case, or suggest that the case has merit,” Jean-Pierre added.

The crucial question now is whether the issue will be resolved before Jan. 1, when payments on federal student loans are expected to restart after being paused during the pandemic. Millions of Americans were expected to get their debt canceled entirely under Biden’s plan, but they now face uncertainty about whether they will need to start making payments in January.

Trending Now

Over 1.5M dry shampoo products recalled in Canada over cancer risk

Hedley frontman Jacob Hoggard sentenced to five years, granted bail pending appeal

1:02

Biden forgives $10,000 in student loans for millions of Americans

Biden has said his previous extension of the payment pause would be the final one, but economists worry that many Americans may not have regained financial footing after the upheaval of the pandemic. If borrowers who were expecting debt cancellation are asked to make payments in January, there’s fear that many could fall behind on the bills and default on their loans.

A notice of appeal to the Eighth U.S. Circuit Court of Appeals was filed late Thursday, hours after U.S. District Judge Henry Autrey in St. Louis ruled that since the states of Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina failed to establish standing, “the Court lacks jurisdiction to hear this case.”

Separately, the six states also asked the district court for an injunction prohibiting the administration from implementing the debt cancellation plan until the appeals process plays out.

Biden blasted Republicans who have criticized his relief program, saying “their outrage is wrong and it’s hypocritical.” He added, “I don’t want to hear it from MAGA Republican officials” who had millions of debt and pandemic relief loans forgiven, naming GOP lawmakers like Reps. Vern Buchanan and Marjorie Taylor Greene, who received loan forgiveness, and Sen. Ted Cruz, who called some beneficiaries of student loans ”slackers.“

Asked Biden, “Who the hell do they think they are?”

The Congressional Budget Office has said the program will cost about $400 billion over the next three decades. James Campbell, an attorney for the Nebraska attorney general’s office, told Autrey at an Oct. 12 hearing that the administration is acting outside its authorities in a way that will cost states millions of dollars.

The announcement immediately became a major political issue ahead of the November midterm elections.

Conservative attorneys, Republican lawmakers and business-oriented groups have asserted that Biden overstepped his authority in taking such sweeping action without the assent of Congress. They called it an unfair government giveaway for relatively affluent people at the expense of taxpayers who didn’t pursue higher education.

Many Democratic lawmakers facing tough reelection contests have distanced themselves from the plan.

Justice Department attorney Brian Netter told Autrey at the Oct. 12 hearing that fallout from the COVID-19 pandemic is still rippling. He said student loan defaults have skyrocketed over the past 2 1/2 years.

Other lawsuits also have sought to stop the program. Earlier Thursday, Supreme Court Justice Amy Coney Barrett rejected an appeal from a Wisconsin taxpayers group seeking to stop the debt cancellation initiative.